Buckle Up For A Crashing Economy And More Inflation

(Michael Maharrey ) Jerome Powell began hinting that inflation might be a problem last August. In November, Powell retired the word “transitory.” But here we are in May and the Federal Reserve still hasn’t done anything substantive to address the inflation problem.

And now it may be too late. It’s probably time to buckle up for more inflation – and perhaps a crashing economy.

Powell and Company have been talking tough for months, but there hasn’t been a whole lot of action. In March, the central bank raised interest rates a paltry 25 basis points. At the May meeting, the FOMC followed up with a more aggressive 1/2% rate hike but took a 75 basis point rate hike off the table.

Meanwhile, the Fed didn’t even start tapering quantitative easing until January. In mid-April, the balance sheet was still expanding, hitting an all-time high of $8.97 trillion.

At the May FOMC meeting, the Fed unveiled its balance sheet reduction scheme. It was hardly impressive. If the Fed shrinks its balance sheet at the proposed rate, it will be back to pre-pandemic levels in about eight years.

The Fed has targeted a 2.5% interest rate by the end of the year. With GDP already going negative in Q1, it’s questionable that the Fed can get there without completely tanking the economy. There are already signs that the Fed has pricked the housing bubble.

And as Mises Institute senior editor Ryan McMaken pointed out in a recent article, the Fed really needs to push rates much higher than 3%.

One percent may seem high to some market observers of recent rate cycles, but we’re now in a high-inflation environment with price inflation above 8 percent. The Fed is going to have to do more than a mild hike here and there to make a dent in 8 percent CPI (Consumer Price Index) inflation. Even mainstream observers recognize this, and Ken Rogoff this week suggested that the odds of success in bringing down inflation with rate hikes of 2 percent or 3 percent ‘is really unlikely. I think they’re going to have to raise interest rates to 4% or 5% to bring inflation down to 2.5% or 3%.'”

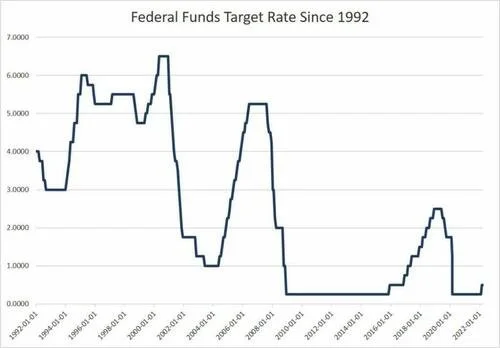

Needless to say, this is also highly unlikely. The Fed funds rate has not risen above 2.5% since the 2008 financial crisis. The last time interest rates were above 5% was August 2007 – as the housing bubble was deflating and setting up the ’08 crash.

McMaken sums it up this way.

So as we look to the May Federal Open Market Committee meeting, the likely scenario is a small rate hike in the face of 8 percent inflation, with no significant changes to the balance sheet. That’s what we’re likely to get after months of increasingly hawkish talk from the Fed: Virtually nothing.”

And as already mentioned, the economy has started to sour, even though the Fed is just getting into the ring for this inflation fight. McMaken said, “It is increasingly clear why the Fed is unwilling to make any sudden movements.”

The economy is increasingly weak, and those in favor of the narrative that the US is in the midst of an economic boom have nothing to stand on but a low unemployment rate.”

Fed Chair Jerome Powell and others continue to harp on low unemployment and a labor shortage as signs of a booming economy. But as McMaken points out, “reciting employment statistics in the midst of forty-year inflation highs and a shrinking economy has its limits.”

In fact, it betrays a sizable level of denial since, as Danielle DiMartino Booth noted on Tuesday, ‘Unemployment is the most lagging of all economic indicators.’ If Powell relies on unemployment numbers to explain why the economy is ‘strong,’ he will simply ‘evicerat[e] his credibility.'”

Peter Schiff questioned the Fed’s credibility in a recent podcast, saying it’s in a very precarious position.

What happens when we end up in a recession? What happens to the Fed’s credibility? Because, after all, they’ve got everything wrong. First, they said there’s no inflation. Then they said inflation is transitory. Then they admit they got that wrong. And now they see this negative GDP number, and basically, they say that’s transitory too.”

In reality, an evaluation of the economic data has to make any honest person scratch their head and wonder just how strong the economy really is. McMaken sums up the situation nicely.

The reality is that the economy is contracting and personal finances are worsening. Inflation is high and wages are not keeping up. Under these conditions, the Fed will desperately want to embrace more easing so as to stave off a full-blown recession. An example of the Fed tightening just as the economy is weakening? That’s practically a unicorn. The big exception, of course, is Paul Volcker who in the economically weak days of the early 1980s embraced true monetary tightening to reduce inflation. It’s hard to see how Powell could do the same, as Powell has continually demonstrated that his Fed is very much a Fed committed to kicking the can down the road to serve short-term political interests. This is an election year, after all.

“That means it’s time to buckle up for more inflation. And, ultimately, we may get a recession anyway since it may be that all that is necessary to send the economy over the cliff is just another rate hike or two of 0.25 or 0.50 percent.”